FICO scores can be a mystery. FICO is the most popular credit scoring model used by 90% of banks. While the people over at FICO do not release exactly how credit scores are calculated – They do give some insight into the main components making up a FICO score.

Changes were made to the way FICO scores are calculated in 2014. The newest edition, FICO Score 9, does not include paid collection accounts and it will differentiate medical collection accounts from non-medical debt.

Unfortunately, it is up to each lender to implement the newest scoring model. Nevertheless, knowing what components affect your credit score can give you an advantage when working on improving scores.

If your FICO scores are low you can take steps to improve your creditworthiness and if it’s high you may be able to use it as leverage to get the best rates and terms.

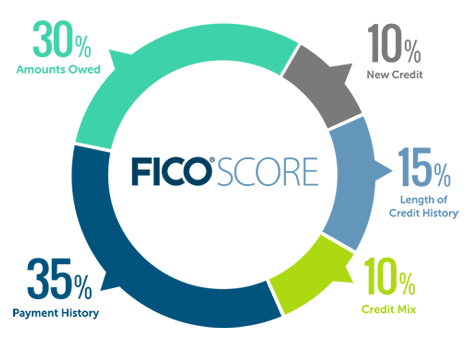

5 major factors that make a credit score

1. Payment History

Whether you pay obligations on-time or late is the greatest factor impacting credit scores. Payment history makes up 35% of your overall credit score. Having one late payment could take as much as 110 points off your credit score. On-time payment history can means the difference between poor, good, and excellent credit. There are strategies to recover from late payments.

Learn how to time your payments to get the best credit scores.

2. Amount Owed

The amount owed is the next major component, making up 30% of your credit score. The amount of revolving debt owed in comparison to your available credit limits is calculated on an individual account basis as well as an overall basis.

Your total debt will weigh heavily on your credit score. Borrowing more than 10% of your available credit limit may suppress your credit score. Ideally, using 7% or less of your available credit limit is optimum. Paying off credit cards can help increase scores. The simplest way to pay off credit card debt is with debt consolidation.

Payoff is an online lender that states you can increase your FICO® Score by up to 40+ Points* by paying off credit card debt.

FICO released a study stating consumers with the highest credit scores use 7% or less of their available credit limits. With this in mind, consumers should steer clear of maxing out one card for all of their purchases. It would be better to spread smaller debt amounts over several cards rather than max out one credit account.

Courtesy: myFICO.com

3. Length of Credit History

The length of credit history makes up 15% of your credit score. This is why consumers with longer credit histories are able to achieve those seemingly elusive 800 and above credit scores.

Typically, in order to achieve higher credit scores, you must have “OPEN” accounts for at least 7 years and the accounts must be in good standing with an excellent payment record. You can actually raise your credit score by keeping accounts open past 7 years.

There may be accounts that have been unused for several years but remain on your credit report. Do not close old, unused accounts, leave them alone. Ideally, let older accounts remain open with a small amount of activity that is paid in full monthly.

4. Hard Inquiries and New Debt

Hard inquiries along with new debt account for about 10% of your score. Opening many credit accounts at one time signals to creditors you may be experiencing financial difficulty. The credit scoring model will ding your credit score and view you as high risk for creditors.

The exception to having lots of hard inquiries is when you are shopping for a big purchase such as a mortgage or automobile loan. All mortgage inquiries made within 30 days of each other will be grouped as one inquiry. All auto loan inquiries made within 14 days will be grouped together as one.

5. Credit Mix

The type of credit accounts you have makes up 10% of your credit score. Your credit score gets a boost when show you can manage multiple types of debt such as a mortgage loan; automobile loan; line of credit and credit cards. Installment loans such as an auto loan hold more weight than revolving debt such as a credit card.

(More: Overview of FICO’s Newest Version)