The Federal Housing Administration (FHA) is part of the United States Department of Housing and Urban Development (HUD) and is the largest government insurer of mortgages in the world.

Since its inception in 1934, FHA has insured over 34 million properties by providing mortgage insurance on single-family, multifamily, manufactured homes and hospital loans made by FHA-approved lenders.

The FHA does not actually make home loans. It guarantees lenders will be repaid if you default on the loan. The mortgage insurance provided by FHA pays the lender in case of default. Borrowers must qualify and meet lender requirements but the lender bears less risk because FHA insures the mortgage loan.

There are many benefits and protections that come with FHA loans but there are drawbacks too.

FHA loans require low down payments and typically have less strict underwriting standards than conventional loans. But they now require mortgage insurance for the life of the loan. This requirement can make FHA loans more expensive than conventional mortgage loans. There are two mortgage insurance premiums required on all FHA mortgage loans:

- For a 30-year loan with a down payment of less than 5%, your premiums will be 0.55% of the outstanding balance each year. If you put more than 5% down on a 30-year loan, your annual premiums will be 0.80%.

- Upfront premium is 1.75 percent of the loan amount — $1,750 for a $100,000 loan. This upfront premium is paid when the borrower gets the loan. It can be financed as part of the loan amount.

If you keep your FHA financing for 30 years, you’ll pay significantly more in mortgage insurance premiums than you would with a conventional loan and private mortgage insurance.

However, the benefits of FHA-backed mortgage loans still outweigh the drawbacks. For many first-time homebuyers, FHA is the way to go and here is why:

Bad credit is okay with FHA Loans

The FHA credit score requirements for 2024 continues to make FHA loans easier to obtain than regular conventional loans. FHA loans have flexible income, debt, and credit requirements to help borrowers qualify. FHA can help a consumer qualify with less than perfect credit. Unlike conventional loans, FHA views a consumer’s credit history with reasonable credit underwriting and does not solely rely upon credit scoring.

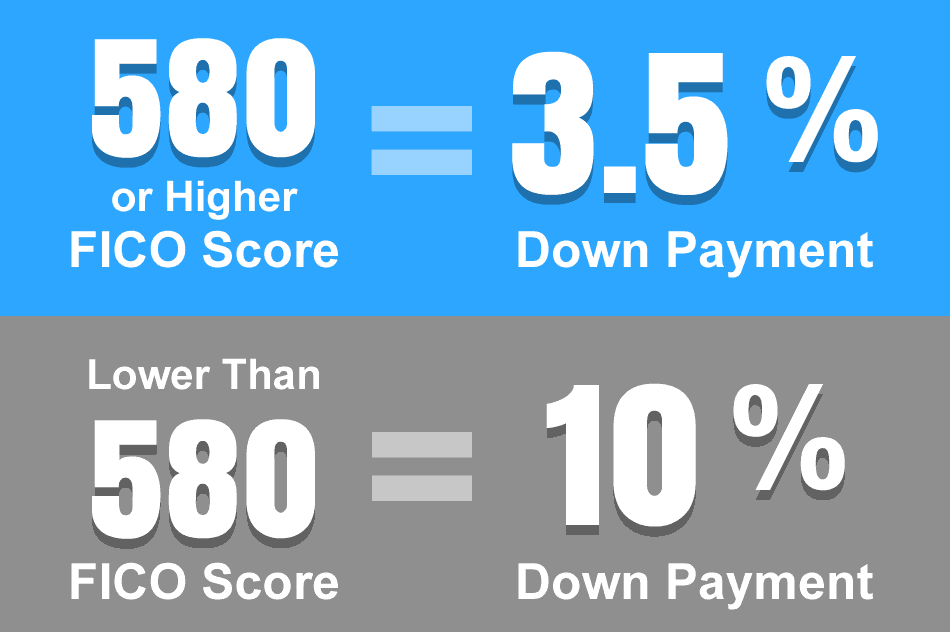

For borrowers whose credit scores are between 500 and 579 a maximum LTV of 90% applies which means borrowers in this category must have a 10% downpayment. Borrowers with credit scores 580 or above are eligible for maximum financing which means a 3.5% downpayment is required.

Many participating FHA lenders require a credit score of at least 620 in order to qualify. Lenders have the autonomy to set their own credit score requirements even though participating in the FHA program. Get quick tips to raise your credit score if it’s below 620.

Non-traditional credit sources can be used for loan approval

Lenders can check “non-traditional” credit sources and build a credit report if you don’t have enough accounts to generate a score. FHA takes into consideration borrowers that have thin or no credit files. They realize not everyone uses credit. In cases where you have little to no credit history FHA may consider on-time payments to the following:

- utility payment records

- rental payments

- automobile insurance payments, and

- other means of direct access from the credit provider

FHA’s policy says the lack of a credit history, or the borrower’s decision to not use credit, may not be used as the basis for rejecting the loan application.

Get your on-time rent payments added to your credit reports.

FHA Requires a low down payment

FHA requires a 3.5% downpayment which can be funded by a gift from a family member, employer, charitable organization or grant. Available on 1-4 unit properties. Every state has some kind of down payment assistance program, find one in your State.

FHA offers competitive interest rates

Because FHA loans are insured by the government, lenders can offer some of the best interest rates.

Easy qualifying for FHA mortgage loans

The requirements for loan qualification are often easier than conventional mortgage loan qualification because lenders have the assurance that mortgages are backed by the government.

FHA loan closing costs may be covered

The FHA allows home sellers, builders and lenders to pay some of the borrower’s closing costs. That may include appraisals, credit reports or title expenses.

Good Neighbor Next Door Sales Program

HUD offers a substantial incentive in the form of a discount of 50% from the list price of a home in HUD designated revitalization areas. In return you must commit to live in the property for 36 months as your sole residence. In order to qualify you must be one of the following:

- Law enforcement officer

- Pre-K through 12th grade teacher

- Firefighter

- Emergency medical technician

Manufactured and Mobile Homes

FHA has two different loans for manufactured and mobile homes, one for borrowers who own the land and the other for mobile homes located in mobile home parks. Get more information from HUD.

Funds for Fixer-Uppers, Repair and Remodeling

HUD’s 203(k) program can help you purchase or refinance a property and include in the loan the cost of repairs and home improvement. FHA “streamlined” 203(k) allows borrowers to finance up to $35,000 for nonstructural repairs, such as painting and replacing cabinets or fixtures. You can also refinance your existing home with FHA and include the costs of remodeling in the new loan. Visit HUD’s 203(k) program for more details.

Reverse Mortgage Plans for Seniors

FHA’s reverse mortgage program allows seniors to convert their built-up equity to cash and repayment is only required when the senior no longer uses the home as their principal residence. Reverse mortgages are increasing in popularity with seniors, it is a way to supplement their income. The only reverse mortgage insured by the U.S. Federal Government is called a Home Equity Conversion Mortgage or HECM, and is only available through an FHA approved lender. See HUD’s reverse mortgage.

Other Uses of FHA Loans

Loans can be used to make your home more energy-efficient. FHA’s Energy Efficient Mortgage program is for homebuyers as well as existing homeowners. Learn more.

Help to avoid foreclosure

FHA insured loans have many options to help you avoid foreclosure and keep you in your home. One program is partial claim. Under the partial claim program, your lender can obtain a one-time payment from FHA-Insurance fund to bring your mortgage current. FHA will advance the defaulted amount on behalf of the borrower to the lender.

Another relief for FHA borrowers is a temporary period of forbearance, a loan modification that would lower the interest rate or extend the payback period or a deferral of part of the loan balance at no interest.

2024 FHA Limit Guidelines

FHA mortgage loan limits vary by State and Counties, with larger loan amounts allowed in areas with higher housing costs. To better understand how the limits are set, see MORTGAGEE LETTER from HUD dated November 30, 2021.

For 2024, the FHA floor was set at $420,680 for single-family home loans.

FHA’s 2024 minimum national loan limit “floor”, of $420,680 is set at 65 percent of the national conforming loan limit. This “floor” applies to those areas where 115 percent of the median home price is less than the “floor” limit. Any area where the loan limit exceeds this “floor” is considered a high-cost area. FHA’s maximum loan limit “ceiling” for high-cost areas is set at $970,800, which is 150 percent of the national conforming loan limit.

2024 Loan Limits for low-cost areas:

| Single-family | $472,030 |

| Duplex | $604,400 |

| Triplex | $730,525 |

| Fourplex | $907,900 |

2024 Loan Limits for high-cost areas:

| Single-family | $1,089,300 |

| Duplex | $1,394,775 |

| Triplex | $1,685,850 |

| Fourplex | $2,095,200 |

Mortgage limits for the special exception areas of Alaska (AK), Hawaii (HI), Guam (GU), and the Virgin Islands (VI) are adjusted by FHA to account for higher costs of construction. These four special exception areas have a higher ceiling as follows:

| Single-family | $1,089,300 |

| Two-family | $1,394,775 |

| Three-family | $2,253,700 |

| Four-family | $2,800,900 |

The information above is not guaranteed as the current economic challenges have created a need for FHA to regularly adjust and update mortgage loan limits. The most accurate information can be found at https://entp.hud.gov/idapp/html/hicostlook.cfm for your specific State and County.

In short, FHA loans make sense for many consumers because they offer:

Less Stringent Qualifications

FHA provides mortgage programs with easier requirements. This makes it possible for most borrowers to qualify, even those with questionable credit history and low credit scores.

Competitive Interest Rates

Typically, when a homebuyer has low credit scores, the only option is a subprime mortgage. FHA loans offer low-interest rates to help homeowners afford their monthly housing payments.

Bankruptcy

FHA loans are available to people who filed bankruptcy or experienced a foreclosure to apply for a loan. Borrowers must wait out the FHA’s minimum time period of two years after the discharge date of a Chapter 7 Bankruptcy plus any additional amount required by the FHA lender. It’s best to show you have engaged in rebuilding your credit after bankruptcy and have current on-time credit accounts.

Foreclosure

Borrowers with a foreclosure must wait three years before applying for an FHA loan. This is lenient compared to conventional lenders who typically require you to wait seven years after a foreclosure. They want to see you are rebuilding your credit after foreclosure and managing debt well.

Determining Credit History

Bad credit is not necessarily a problem when applying for an FHA loan. There are many ways a lender can assess your credit history. The key is to show that you have improved in making payments and that any late payments or even collection accounts were isolated incidences that can be reasonably explained.

Collection Accounts / Charge-Offs

FHA Guidelines On Charge Offs And Collections does not require borrowers to pay outstanding collections and charge-off accounts to qualify for FHA Loans. You can get approved for an FHA mortgage loan with an unpaid charge-off or collection account. However, an individual FHA Lender may require charge-offs and collection accounts be paid.

Keep in mind that each individual FHA Lender can either go strictly by FHA Guidelines; or, use a combination of FHA Guidelines along with their own guidelines. Additional FHA Lender Guidelines are referred to as “overlays.” Mortgage lender overlays are mortgage lending guidelines that a particular lender will impose in addition to those set by FHA, even though FHA may not require it.

For many homebuyers, using an FHA loan can really make the difference between owning your dream house comfortably or turning it into a financial nightmare. The FHA provides a wealth of benefits for applicants that qualify, so make sure you’re making full use of them. Learn more about why homeownership is important.