Bad credit car dealerships are necessary when you have less than perfect credit. But not all bad credit car dealerships operate in good faith.

People looking for a bad credit car loan can often fare better by obtaining car financing prior to visiting bad credit car dealerships.

Never assume a bad credit car dealership will offer you the best rate.

The dealership may have an incentive for the car buyer to finance through a “Buy Here, Pay Here” loan. Buy Here, Pay Here dealerships are often the lender themselves and finance the cars they sell directly to customers. These types of loans almost always carry higher interest rates and less favorable terms.

In early March, a woman went viral for one such car loan with the following alleged terms:

- Vehicle: 1998 Ford Escort

- Monthly payment: $289

- Terms: 84 months (7 years)

At the end of the loan she will have paid over $24,000 for a 24-year old car.

The Math Ain’t Mathing 🥴 Shawty signed a whole 360 deal😩✍🏼💯 pic.twitter.com/HVl5W4MQH4

— Raphousetv (RHTV) (@raphousetv2) February 25, 2023

Another issue with “Buy Here, Pay Here” dealerships is the inflated costs for vehicles. Because Buy Here, Pay Here dealership are often a last resort, car buyers don't negotiate the price of the car.

While some “Buy Here, Pay Here” dealerships offer competitive rates, many don't. The average interest rate on a “Buy Here, Pay Here” auto loan ranges from 15% to 20% according to Forbes. Bad credit borrowers may end up in a worse situation by defaulting on the car loan.

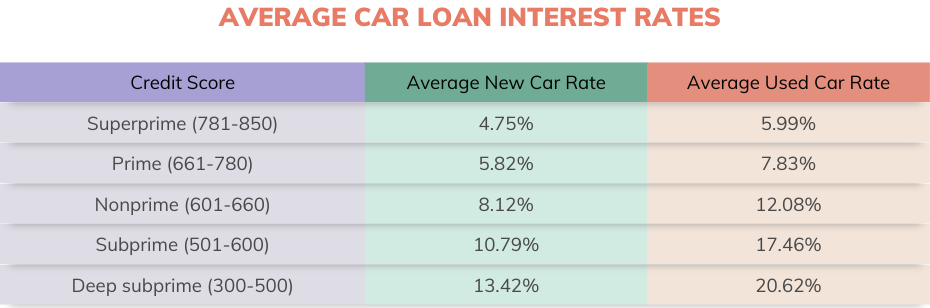

Good credit score borrowers pay much less in interest and save money. Check out the below interest rate comparison chart with stats from Experian’s latest State of the Automotive Finance Market report.

5 Alternatives to Bad Credit Car Dealerships

Shop around for lenders that offer bad credit car loans; your credit may not be as bad as you think. Different lenders offer different rates plus, securing your financing before you walk into a car dealer puts you in control and can save you money.

Waiting until you’re at the dealer to finance a car loan isn’t always the best idea. We have done a little research by finding online car lenders for bad credit.

Get pre-approved for the best loan you can find before you head to the dealer.

1. CarsDirect

CarsDirect specializes in helping people rebuild their credit. They have a no-hassle process that can be started online in as little as 60 seconds. There is no obligation. Since 1998 CarsDirect's lender network has helped millions of customers get new and used car loans with custom tailored financing. The company works with a network of dealers.

2. Max Car Loan

MaxCarLoan has an extensive network of auto dealers and direct lenders with one simple application. Loan applications are accepted for both new and used cars.

3. InstantCarLoan

InstantCarLoan.com helps car buyers get approved that have missed payments, repossessions, foreclosures, collection issues, charge offs or any other delinquencies on your credit report. The biggest drawback is that car buyers can only choose from used cars. However, InstantCarLoan has been providing car buyers with a variety of credit backgrounds safe and trusted auto loans for over 10 years.

4. 1800FreshStart Auto Loan

1800FreshStart.com will work with car buyers regardless of credit scores. They will help people who experienced repos, foreclosures, late payments, bankruptcy and more. Car buyers with a variety of credit backgrounds, even first time buyer can get approved. Car loans range from $3,000 to $45,000. You can prequalify in minutes.

5. UpStart Auto Refinance

If you're looking to reduce your car loan payments, Upstart offers auto loan refinancing. No minimum credit history is required, and they offer competitive rates from multiple lenders to help get you the best deal possible.

Why pre-approval for a bad credit car loan is important

Getting pre-approved, with a bad credit loan agreement in place, prior to choosing your car is important. Pre-approval streamlines the negotiation process. Car salesmen love to negotiate “monthly payment” with car buyers instead of interest rate. Negotiating the lowest possible interest rate and price of the car is what will make the difference in monthly payment and how much you pay for the car over the life of the loan.

The above comparison chart shows how much you save depending on the interest rate. When you’re pre-approved, you become a “cash buyer” and cash buyers hold the power in negotiations.

Choose the shortest loan terms possible

When you get a bad credit car loan it's important to choose the shortest loan terms you can afford. Loan terms are typically 36, 48, 60, 72 or 84 months. The longer your loan terms, the lower your monthly payment will be but, you'll end up paying much more in interest for the car. It’s best to pay off a car loan quickly since cars depreciate rapidly. Owing more on the loan than the car is worth is called being “underwater” or “upside down,” which is a risky financial situation.

Limit your car loan search to a 2-week timeframe

When you want to get the best car loan with bad credit, you may have to shop several lenders. This can wreck havoc on an already damaged credit score. The good news is that scoring models usually count every credit inquiry performed by an auto loan lender within a 2-week time frame as just one inquiry. That means you should only apply for auto loans when you are actually ready to take one out. Otherwise, you risk making your credit score problem worse. Check out more tips to get approved for a car loan with bad credit.

Don't leave a car dealership before you finalize financing

Never drive-off a car dealership in your new car without finalizing financing. Some dealerships will offer you financing “based on final approval,” and will let you drive-off the lot before your financing is actually finalized. A day or two later you get a call from the dealership saying financing was not approved at the agreed upon rate but they have financed you at a significantly higher rate.

This is a cruel tactic often used on eager car buyers with bad credit who may not be familiar with the process. Dealers are acutely aware of the desperate situations bad credit car buyers can find themselves.

Conclusion

Don't be fooled into thinking you have no choice. Even if you have bad credit, there are lenders that are willing to finance your car purchase. If you choose a Buy Here, Pay Here lender make sure they report to the major credit bureaus. That way, you’ll earn credit for making the payments on time.